Here’s the big question: Is Trump’s proposed economic decoupling from China really a smart move for America? Or is it just a political stunt to secure a few votes, all while leaving regular Americans to foot the bill with pricier groceries and household goods?

Sure, Trump’s strategy—aggressively raising tariffs on Chinese goods up to 60%—sounds like a bold move on paper. It’s tough, it’s direct, and it certainly rallies his base. But here’s the kicker: While China might absorb some of the blows, it’s the U.S. that’s going to end up with a bill so big it might just make your next trip to the grocery store feel like a trip to the moon.

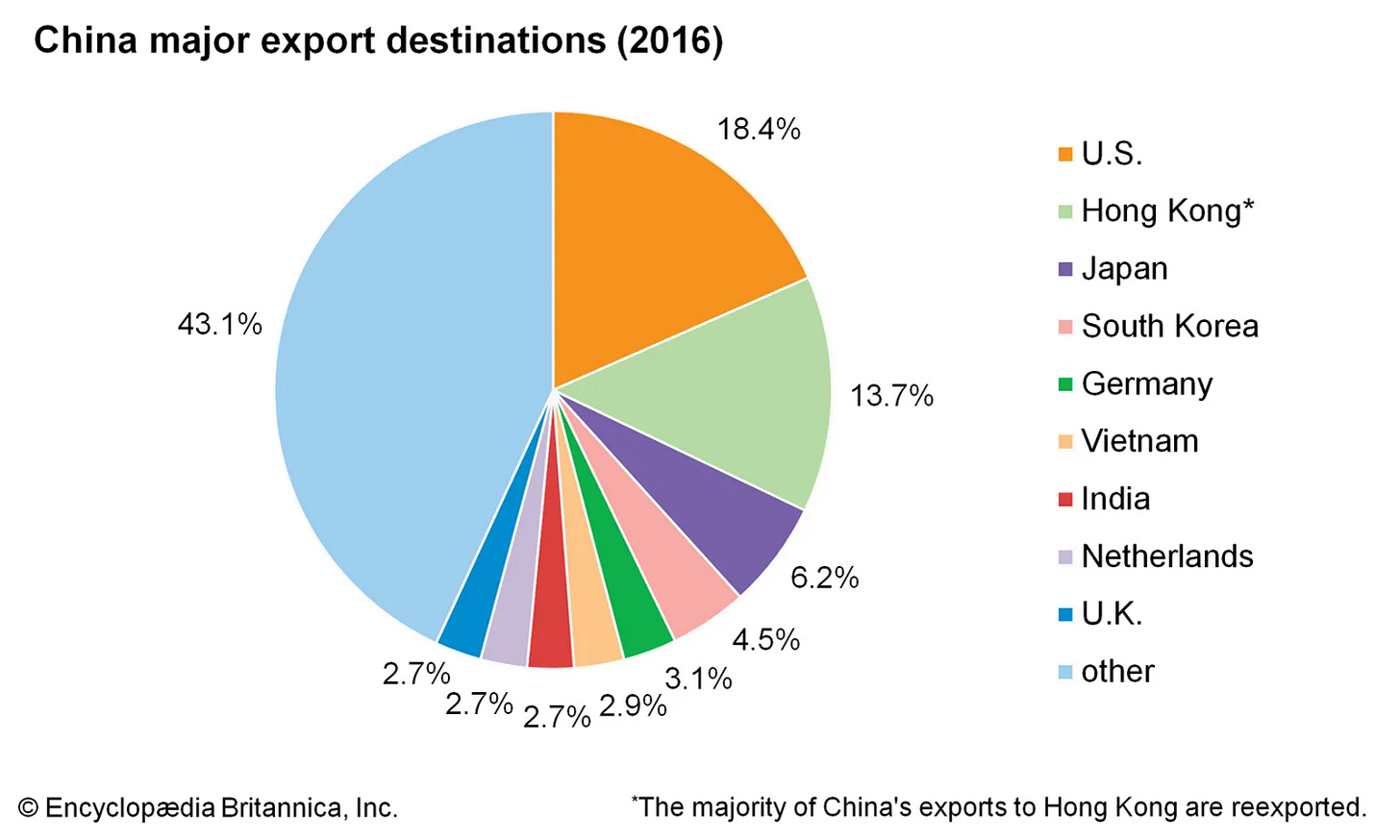

The impact on China, while significant, won’t be as catastrophic as it may seem. The U.S. market accounts for around 18% of China’s total exports, a sizable chunk, but far from an insurmountable obstacle. In fact, the imposition of a 60% tariff will likely have a more profound effect on the U.S. economy than on China’s manufacturing sector. Over the next couple of years, China could reduce its reliance on the U.S. market, possibly shrinking its exports to the U.S. to just 5-8%. This would equate to an 8% loss in trade volume. However, thanks to strategies like currency devaluation—which might offset about 2% of the losses—and China’s ability to move production to other regions, the economic fallout could be relatively mild for China.

The thing is, China’s already ahead of the curve in shifting its manufacturing elsewhere. So, when these tariffs go up, it’s not like China’s going to crumble under pressure. Nope. They’ll shift trade deals and strengthen other partnerships. Meanwhile, the U.S. is left struggling to reshore thousands of products it once relied on China to produce—products that aren’t just going to appear overnight on American shores.

But wait, there’s more! Picture this: You think your grocery bills are bad now? Just wait until higher tariffs raise the cost of everything from electronics to, you guessed it, the food you buy. The U.S. is deeply intertwined with China’s supply chain—especially in electronics, manufacturing, and even agriculture. Full decoupling would disrupt these sectors, raising costs for businesses. And you know what that means, right? Yep, you guessed it: more expensive stuff for consumers. Higher inflation, fewer deals, and, oh look! Yet another bill passed on to the average American.

Meanwhile, what’s China losing? Not much, really. While the U.S. struggles to reshape its industries, China’s manufacturing juggernaut is still going strong. In fact, China might even gain more by strengthening its trade with other countries in Asia, Europe, and beyond. So, while Americans might be sweating over their wallets, China is calmly sipping tea, waiting for the dust to settle. Will the BRICS rush to help the Trump administration shift immediately? Who can believe that?

So, is this really all about securing a better future for Americans? Or is it just about riling up a base with political rhetoric that sounds tough but hurts people’s pockets in the process? If Trump’s gamble works out, sure, he might score a few economic points. But if he loses, it could mean even more setbacks for the U.S., all while China strolls into the future with a bigger, stronger economy. Does that sound like a win for America?

What would I be thinking if I were a U.S. citizen? Maybe, just maybe, we should ask ourselves: Do we really want to “decouple” from China, or is this just a bad excuse to pay more for our groceries? Because, let’s face it: The only thing that’s really going to “decouple” is our money from our wallets.

- #TrumpEconomics

- #TariffWar

- #USChinaTrade

- #GlobalTrade

- #EconomicImpact

- #TradePolicy

- #Inflation

- #SupplyChain

- #ChinaTrade

- #USPolitics

Thanks for reading DANIELE PRANDELLI! This post is public so feel free to share it.